What Is Forex Trading And How Does It Work?

Contents:

The Foreign Exchange Market that we see today began in the 1970’s, when free exchange rates and floating currencies were introduced. In such an environment only participants in the market determine the price of one currency against another, based upon supply and demand for that currency. For new investors, the forex market might seem boring as the exchange rates move at a snail’s pace especially when compared to the stock market. But what makes the currency market the most liquid and opportunity-rich market in the world is “Leverage”. Forex traders aim to speculate or hedge against future exchange rate fluctuations rather than physically acquiring currencies.

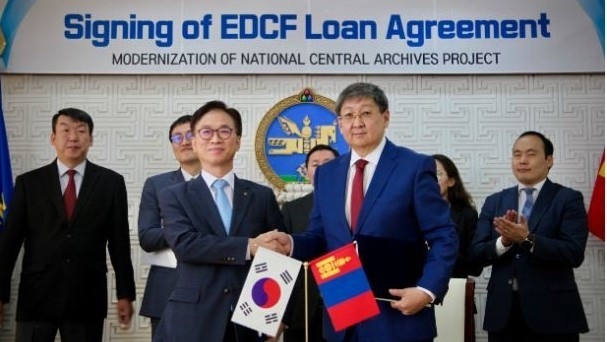

So, for instance, when the forex trading day in the US closes, the currency markets start in Hong Kong and Tokyo. As such, the market of forex is an extremely active market at any time, and quotes of prices are bound to keep changing. Historically, SMBs and individual investors have had limited access to the forex market.

However, if you have specific knowledge about forex markets, you can easily gauge how trading occurs. A distinctive aspect of the forex market is that it is truly international in nature, and there is no central or single marketplace regarding forex. Instead, currencies are traded electronically via OTC or over-the-counter trades. This translates to the fact that most transactions occur through networks of computers with a vast number of traders all over the globe.

Download ET App:

The best way to manage high leverage risk is to deploy a stop-loss on each trade. Leverage in forex trading is expressed as a percentage or “X” of your deposit. By Deepika Khude Deepika Khude The author is a Certified Financial Planner with 5 years experience in Investment Advisory and Financial Planning. Her strength lies in simplifying complex financial concepts with real life stories and analogies. Her goal is to make common retail investors financially smart and independent. If your position is loss-making, your broker will “margin call” you so that you can make up the difference.

- One of the main advantages of automated trading platforms is that it allows traders to remove the emotional element from their trading decisions.

- Gone are the days when carrying bundles of cash or traveller’s cheques was the norm.

- Your Forex Card will be activated with the loaded currencies within 24 hours of the bank getting clear funds from your end.

- This category deals with best news and updates on marketing and branding news and events.

You need to learn how to operate the software, do analysis, and manage the risk in the account. We have an education section to continue reading and explore many of the principles to succeed in trading. Fundamental analysis is the study of macroeconomic trends and their effects on price, this form of analysis requires a sound knowledge of economics and current events. In the broadest sense, Fundamental traders try to buy currencies from stronger economies at a low price and sell currencies from underperforming economies. All trading strategies will require you to engage in market analysis in order to be successful.

Forex Market Hours

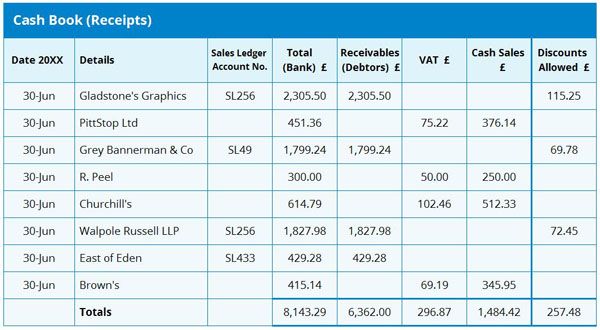

So, 300 pips multiplied by what are your options if you can 039 t get a bank 0.10 gives you a profit of USD 30. This category deals with best news and updates on marketing and branding news and events. Forex markets can further be classified into three categories – Spot Forex Market, Forward Forex Market and Future Forex Market. I want to note that the offer price of any financial instrument is always higher than the ask price.

- The aim is to speculate whether the exchange rate between the two currencies will rise or fall.

- Firstly, it is one of the few markets in which it can be said with very few qualifications that it is free of external controls and that it cannot be manipulated.

- The Forex market is the largest and most liquid financial market in the world, with a daily trading volume of approximately 500 trillion Rupees (6.6 trillion USD – 2019).

- So, if you have got some answers to the question, “What is forex trading?

- Technical analysis can be tough to learn, but once you have a good understanding of the basics it can be used in any financial market, not just the Forex market.

- Let somebody throw more light on that and demonstrate a few instances in a comprehensive manner.

These are open for the purchase and sale of currencies all day . The markets are prepared for trading all five working days in the week. The Forex market is the largest and most liquid financial market in the world, with a daily trading volume of approximately 500 trillion Rupees (6.6 trillion USD – 2019). And Forex trading is buying and selling currencies on this market. A forex trader will buy a currency at the current market price and sell it again at a target price in the future.

Can I transfer money from my forex/ forex prepaid card to my bank account?

BankBazaar does not provide any warranty about the authenticity and accuracy of such information. BankBazaar will not be held responsible for any loss and/or damage that arises or is incurred by use of such information. Rates and offers as may be applicable at the time of applying for a product may vary from that mentioned above. Forex trading is typically done through a broker or market maker. As a forex trader you can choose a currency pair that you feel is going to change in value and place a trade accordingly.

Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 1, 2020. Forward contracts are sales or purchases of a given amount of currency at a specific price at a future date. It works on the VISA network and can be used at ATMs abroad to withdraw cash whenever needed. The nifty in-app ATM Locator feature can help you find an ATM close by. Niyo Global is a zero balance account, meaning you don’t need to maintain an average balance in your account.

All the relays terminate at a base station with Fiber connectivity.Wi-Fi devices connecting to TV band backhau lis depicted. A dual-band Access point (2.4 GHz and TVWS) facilitites connectivity to the end users. The last mile access technology is Wi-Fi as these devices are readily available at low costs.

This resulted in a huge increase in the value of the franc versus the euro – moving from 1.2 CHF/EUR to 0.86 within hours of the news. As currencies are quoted in pairs, the value of the quote currency is set in relation to the base currency. Let us take a close look at the meaning of foreign exchange.

International banking made simple by Niyo Global

This actually helped me a lot, allowing me to practice Forex trading without any risk. Once I was confident that I could manage a few small trades without risking too much, I opted for a live mini account with the same broker. The process itself is rather simple and everything is online. I deposited some money into the account and started trading – and have been doing so ever since.

In most cases, a micro lot is in most cases the smallest trade you can place, though some brokers will offer nano lots of for smaller account types. The largest volume of trades occurs during these times, and currency prices are most active. Of course, there is still some trading activity outside of these main sessions, but it is typically much quieter, and prices may be more stable.

10 Tips To Prevent Losing Money in Forex Trading – ForexLive

10 Tips To Prevent Losing Money in Forex Trading.

Posted: Mon, 29 Aug 2022 07:00:00 GMT [source]

Let us now take a detailed look at online forex trading and also find out about the working of the forex market in India. So, now that you know aboutforeign exchange, read more aboutwhat is a forex cardandhow to use it. But the Forex market liquidity can change during the day, depending on which time zone banks are operating at the moment . For example, the pairs with the Japanese yen will be the most liquid during the working time of Japanese banks. The bank will always buy your currency a little cheaper and sell it to you at a higher rate.

A forex card allows you to load a specific amount of money in any foreign currency. Once you begin your international travels, this card works like an international debit card. You can swipe it at PoS for shopping, use it to buy things online or withdraw cash from ATM. The brokerage rates are similar across all three segments, but more significant trading volumes will lower brokerage expenses. As a result, the forex market is liable to get an edge over the other two here.

This makes it more than three times the size of the U.S. stock market! Unlike other financial markets, there is no central exchange where all transactions occur. Instead, forex trading occurs “over-the-counter” between two parties, typically through a broker or dealer. The transaction of one currency being exchanged for another is termed foreign exchange or forex. This kind of transaction may be conducted for any one of several reasons, like enabling global trade or the purpose of commercial tourism. In terms of trading and making a profit out of forex, forex trading occurs in forex markets.

How do I put money in my forex/ forex prepaid card?

Research and analysis is the foundation of trading endeavors. During researching, you’ll find great amount of forex resources, which is overwhelming at first. But as you research a particular currency pair, you’ll find valuable resources that stand out from the rest. Later in your education you will get to know about pips, but if you are interested, can learn it now from «What is Pip in Forex» article. The exchange rate refers to how much of the USD is required to purchase a unit of the EUR .

Trading Lifestyle: how does forex work? – Evesham Observer

Trading Lifestyle: how does forex work?.

Posted: Thu, 08 Sep 2022 07:00:00 GMT [source]

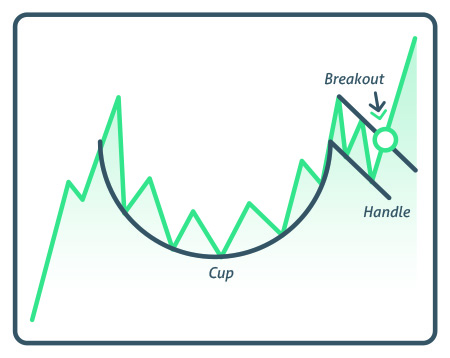

IndusForex strives to provide you with the retail forex solutions at lowest rates to help you save on your every purchase. Book your rates 24×7 with end to end online processing service. Currency traders make decisions using both technical factors and economic fundamentals. The most dramatic price movements however, occur when unexpected events happen. The event can range from a Central Bank raising domestic interest rates to the outcome of a political election or even an act of war. Nonetheless, more often it is the expectation of an event that drives the market rather than the event itself.

Leverage can be used to magnify profits, but it can also magnify losses. Minor pairs – These currency pairs are not traded extensively and include major currencies against each other instead of the USD. Forex trading is the process of buying and selling currencies at agreed prices. Most currency conversion operations are carried out for profit. 4) No need to issue cheques by investors while subscribing to IPO. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment.

And if there is a requirement for technical resources to get the best outcome in trading, we recommend leveraging Forex VPS hosting servers of MilesWeb. These traders comprise individual trader bank officials and fund managers along with multinational organizations. As far as the profits are concerned, all these investment activities are subjected to market risk. Some of these terms and concepts might be tricky to understand at first but it won’t take you long to get it when you see it in action. The best way to learn the basics of Forex trading is to practice on a demo account and place a few trades.

Thus, one can conduct relatively large transactions, very quickly and cheaply, with a small amount of initial capital. Marginal trading in an exchange market is quantified in lots. The term «lot» refers to approximately $100,000, an amount which can be obtained by putting up as little as 0.5% or $500. Another somewhat unique characteristic of the FOREX money market is the variance of its participants.

As we discussed in the section before, a relatively small movement in the derivative contract value can help a https://1investing.in/ trader win big if they’re trading on leverage. CFD traders can speculate on whether an asset will increase or decrease in value and can profit either way. Profiting from the decreasing value of an asset is unique to CFD trading. So, if you buy one standard lot of the EUR/USD, you’re entering a trade worth 100,000 euro . Margin is the amount of money required to open a leveraged position.

Dejar un comentario

¿Quieres unirte a la conversación?Siéntete libre de contribuir!